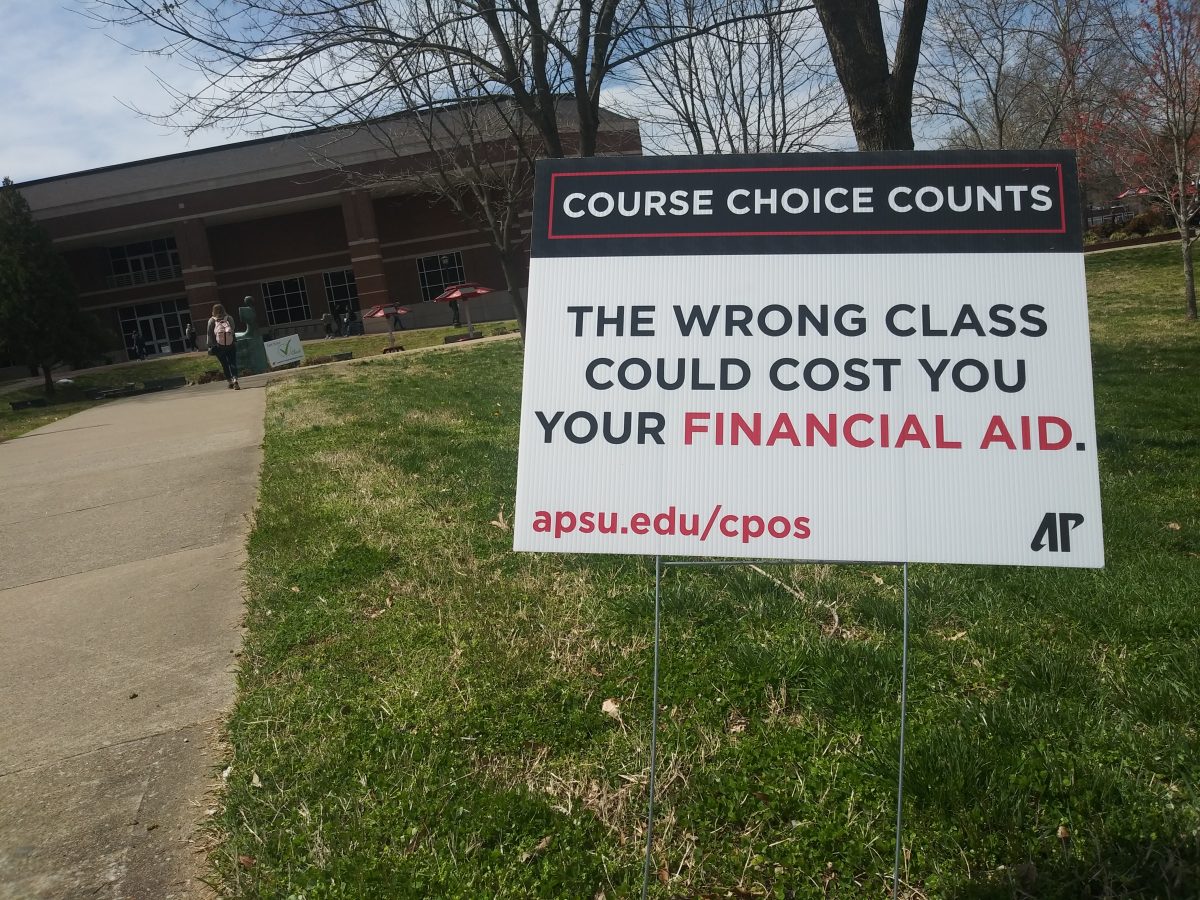

You may have noticed the Course Choice Counts signs around campus.

Course Choice Counts is being announced in big bold letters to any student willing to look up.

This is financial aid’s way of announcing that the Department of Education is placing an emphasis on federal financial aid rules that may impact the amount of aid you receive.

This is referred to as Course Program of Study (CPoS) and may result in the reduction of your scholarships, loans and grants.

Specifically, for federal aid to pay for courses in your major, minor or other degree requirements, it must be part of your program of study or be necessary to earn the total hours required for your degree.

Taking courses that are not a part of your program of study could result in receiving less federal financial aid and potentially having to pay for courses out-of-pocket.

“This is not a new regulation. It’s just one that’s being enforced, and all schools are having to do this. We now have an electronic means for that to work,” Director for the Office of Student Financial Aid and Veteran’s Affairs Donna Price said.

Course Choice Counts is the new tool which, working hand in hand with Degree Works, will enforce this federal policy and verify if your courses are in fact required for your degree during registration.

“Course Choice Counts, the premise behind it is that financial aid is going to operate similar to how VA operates in that it’s going to pay for courses that are within your program of study only,” Price said.

Within AP Onestop and Web Self Service, are links that say Course Choice Counts Information that leads to where students can find out if the courses they have registered for are eligible for their degree or not.

“There’s several tools that will help students, and faculty will have the same tools,” Price said. “Of course, students can’t see anything until they’ve registered for the course. After a student registers, then they can see whether a course is eligible.”

There are some exceptions to what is considered eligible for one’s degree.

“Students can do substitutions, course substitutions. Prerequisites will be considered eligible. Electives are okay. If you’re in a program with electives, you’re most likely not going to have any real issues. Now, some programs don’t really have electives in their program of study. So, there’s less flexibility,” Price said.

It is also important to remember that this regulation only applies to federal aid: Pell Grant, SEOG, Teach Grant, Work-Study and Direct Loans.

Donna Price, Director for the Office of Student Financial Aid and Veteran’s Affairs

It does not impact institutional scholarships or state aid.

However, the cost of attendance will be based on coursework that applies to your declared program of study.

This could result in a reduced amount of state or institutional aid as total aid cannot exceed the cost of attendance.

“Financial aid has really only ever paid for twelve hours. That’s considered full time. There could be some situations where students are enrolled in 15 hours and it’s really no different than it ever has been where students may be paying some out of pocket,” Price said. “Basically, what this will do is students will have to pay more attention to what courses are required for graduation.”

It is also important to note this only affects students moving forward.

You will not have to pay out of pocket for courses you took in the past that was previously covered by federal aid.

You are also still able to change your major.

“You can change your major but then the courses are going to look at what’s required for that program. It’s like anything else with financial aid you have to watch your total attempted hours,” Price said. “Whenever you change your major multiple times, you’re increasing your attempted hours, and you could max out your financial aid.”

Students can also still be undecided.

“You can be undecided. You can’t be undecided [for] more than 60 hours anyway. So, you can take your Gen. Ed. courses. The undecided program is designed, this is not new, for the Gen. Ed. courses. So, if you’re taking courses outside of that, there’s a possibility that a student would have to pay,” Price said.

The Department of Student Financial Aid and Veteran’s Affairs has been trying to communicate all of this to students through their yard signs and emails.

They also hope to set up tables at the Morgan University Center and answer student questions and concerns directly.

However, Price knows communicating the nuances of this change is not always so simple.

“It can be somewhat confusing because it’s new for us too. You still have flexibility, but students have to be much more conscious of what they’re enrolling in and what they’re advised to in working with their advisor,” Price said. “But despite our best efforts for outreach, I do worry about that. I know students don’t like to read their email, but boy do they need to.”

APSU, according to Price, trained with other four-year and two-year institutions that have already implemented CPoS, such as, MTSU and Roane State prior to implementing it here.

“Our goal was to get this out before pre-registration,” Price said. “But Degree Works needed to be implemented first. Before the system was built, I didn’t feel we could communicate clearly with students.”

Communicating clearly this regulation is complex in ways that can be hard to predict.

For example, a graduating senior who has only three required hours left to complete might want to enroll in six hours to be eligible for a federal direct loan.

The student would not be eligible for a federal direct loan under CPoS.

However, you should keep in mind that though your federal aid does not include ineligible coursework, you may still qualify for state and institutional aid based on your total enrollment.

Many other possible scenarios such as this one are explained at apsu.edu/cpos.

“This is new. Degree Works, the evaluation tool is new. We’re expecting there to be some things that aren’t perfect about it. A student could have a situation where they know a course is in their program of study, but it’s showing as ineligible,” Price said. “That’s really when we’re guiding students towards their advisers because they are the ones who really can determine the validity of the course.”

Price, who has been the Director for the Office of Student Financial Aid and Veteran’s Affairs for 16 years, describes the process of preparing for and implementing Course Choice Counts to be among the most expansive.

“It’s the second biggest thing I’ve personally had to implement,” Price said, the first being Banner, the student information system. “I think it is a culture shock for all of us frankly to have this restriction, and I am concerned about that because it’s different. I don’t even know how much to expect in terms of how many students are going to enroll in ineligible courses. I think it’s going to be a little bumpy.”

If things do get “bumpy” and a majority of students decide to enroll in ineligible courses, financial aid will do what they can, but at the end of the day, it is out of their hands.

“I’ve been here a long time, and students are why we’re here, our number one priority, but in the end, it’s their decision. We can’t change what the regulations are, but we can certainly try to improve the clarity, improve the communication, improve the explanation,” Price said.